Inside Deciens AGM 2025

Highlights and takeaways from this year’s program.

Deciens is built on the belief that differentiated returns require a clear view of reality. Our job is to compound human and financial capital at high rates of return, even as the technological, social, political, and economic landscape is profoundly reshaped. Doing that well requires two complementary strengths: dynamic perspective and disciplined execution.

That balance – being nimble when conditions change, staying steady when it counts – shaped our annual general meeting on November 19. We gathered LPs and founders for a candid look at the current landscape. From the State of Deciens and the evolving regulatory environment to conversations with founders and partners, the discussions were thoughtful, direct, and forward-looking.

Here are the highlights.

State of Deciens

The afternoon opened with a note of gratitude as Dan Kimerling (Founder & Managing Partner) set the stage for the day, reflecting on the strength of the team and the community that makes our work possible. He acknowledged the leaders and builders whose conviction and creativity continue to guide our work and remind us of why we do what we do.

The Strategy: Dynamic & Disciplined

Dan outlined how Deciens is approaching this market with a blend of flexibility and adaptability, overlaid with rigor. The message was clear: avoid heroic assumptions, stay grounded in data, and focus on fundamentals that grow and flourish over time.

This shows up in two ways. First, through disciplined concentration – increasing ownership at attractive prices in companies where we have asymmetric information, clear product-market fit, and durable traction, reflecting our belief that a focused portfolio creates multiple paths to meaningful outcomes. And second, by reducing existential risk – supporting founders as they prioritize gross margins, operational efficiency, and early profitability. This combination has helped many of Deciens’ companies navigate a more challenging funding environment with resilience.

Portfolio Highlights

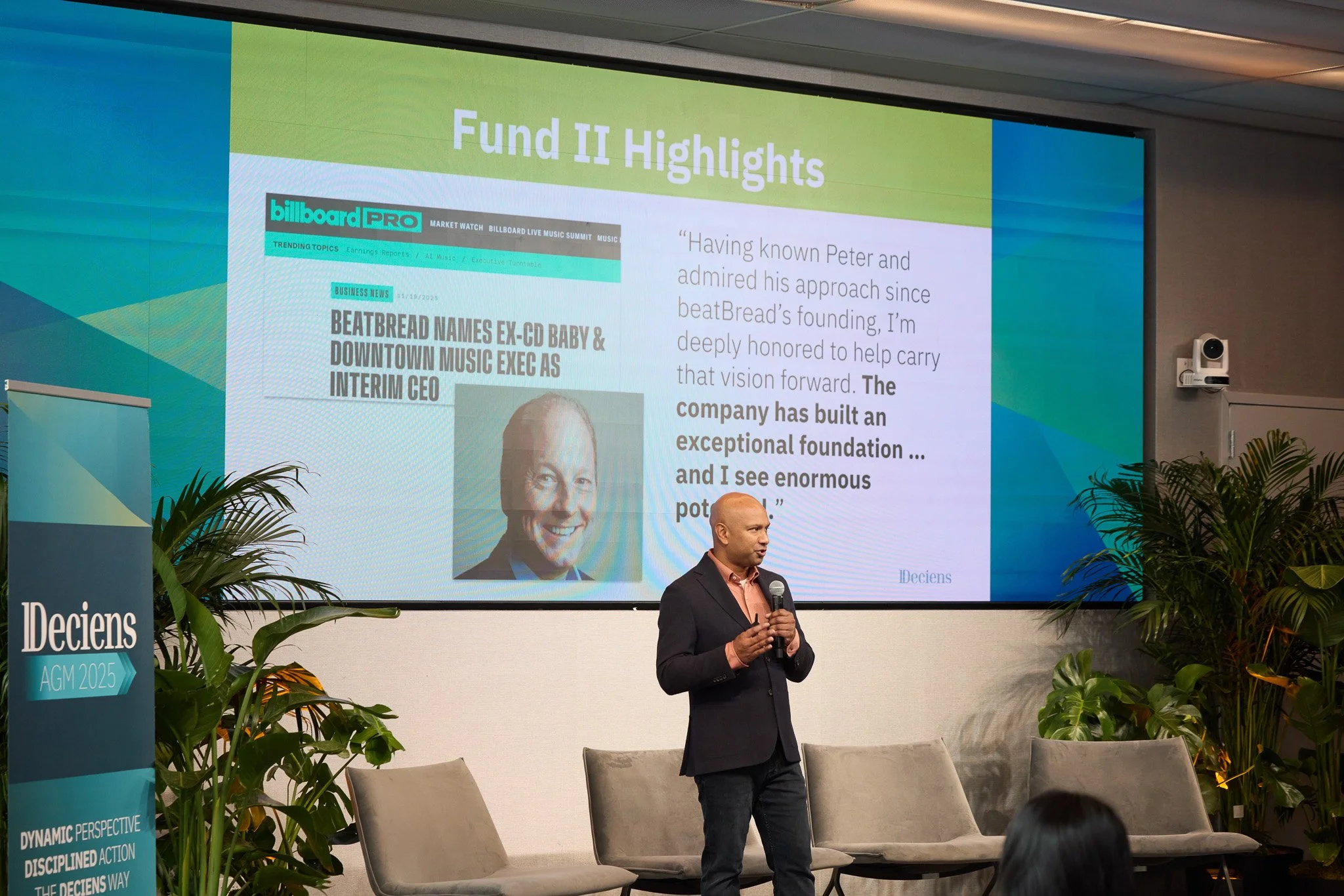

Vishal Rana (Partner, Portfolio & Operations) offered a high-level view across all three of Deciens’ funds, highlighting how disciplined concentration, strong founder partnerships, and steady execution have created a diverse set of opportunities for value creation.

Across the portfolio, some of what we are seeing includes:

Expansion into new geographies, product lines, and distribution channels

Strengthening unit economics

Thoughtful capital allocation

A healthy mix of early breakout momentum, mid-stage scaling, and strong late-stage execution

Taken together, the portfolio reflects a strategy built for durability: a focused set of companies, each with a credible path to meaningful outcomes.

Regulatory Update

Ishan Sachdev (General Partner) opened with a clear message: financial services is experiencing a “regulatory tsunami.” Major shifts across stablecoins, tokenization, bank charters, open banking, crypto, and prediction markets are being shaped not only by what the current administration is changing, but also how it’s doing so.

A case study on prediction markets illustrated this point – how quickly enforcement posture can flip and how valuations and market structure can shift almost overnight. From that example, five regulatory patterns emerged:

Regulation through no-action, rather than new rulemaking.

Federal preemption, effectively overriding state-level rule making.

Open participation, with few guardrails on who can engage.

Removing restrictions on what can be traded – anything can and will be considered a financial product.

Active signaling through direct involvement in favored categories and companies.

The implication for Deciens: regulation is now a core strategic variable. We must underwrite not only where the rules stand today, but where they are likely to be tomorrow.

Company Building in the Time of AI

As we moved into the next part of our day, Dan guided a discussion that stepped beyond AI investing narratives to explore how the technology is reshaping day-to-day company building. Featuring Nathan Wilson (CEO, Generous), Allie Fleder (COO, SimplyWise), and Manik Suri (CEO, GlacierGrid), the conversation focused on practical applications over theoretical promises.

The panelists described how AI is increasing leverage for small teams – enabling higher output with fewer people. They also shared how new tools are accelerating product development and reshaping day-to-day execution. Of particular note were shifting talent strategies, from sourcing specialized AI expertise globally to adopting developer workflows that significantly speed up engineering timelines.

The consensus: AI is transforming the rhythm of company building in real time.

How Sydecar Scales Private Markets

In a fireside chat, Vishal sat down with Nik Talreja, CEO and co-founder of Sydecar, to unpack what it takes to build infrastructure for private markets. Nik shared his path from growing up working in his family business to practicing law and, ultimately, deciding it was nonsensical that trillions in private capital still flowed through bespoke, manual, legal processes.

The rest of the conversation covered the early co-founder challenges that shaped the company, and how those moments reinforced Sydecar’s culture around excellence, humility, commitment, and “winning together.” Nik also discussed Sydecar’s standards-first approach – building SPVs Model-T-style - that can be automated end-to-end – and how AI fits into that vision. Rather than replacing standards, AI becomes the tool to scale them.

Next Gen Financial Institution: June Point Lending (JPL)

This session, moderated by Ishan, featured Brian Hargrave (Managing Director, Nomura) and Viral Shah (CEO, June Point Lending), who explored how traditional banking expertise and modern lending needs came together in the formation of JPL.

Over roughly a year, Viral went from joining Deciens as an Entrepreneur in Residence to starting JPL and then locking its first mortgages only five months after capitalization – an unusually fast timeline in such a regulated, operationally complex space. JPL is focused on the large and growing non-Qualified Mortgage (non-QM) segment: creditworthy borrowers such as founders, small business owners, and investment property buyers who don’t fit the standard Fannie Mae and Freddie Mac underwriting guidelines.

They walked through how a seasoned founder, a strategic capital partner, and a high-conviction investor came together to reimagine a large, complex market. The conversation underscored the importance of deep domain expertise, tight operational discipline, and the catalytic role of conviction capital in helping founders tackle ambitious opportunities.

Why Venture? The Point, the Purpose, and the Portfolio Fit

We concluded the content sessions with a look from the other side of the table. Moderated by Cutler Cook (Venture Partner), panelists Jamil Batcha (Investment Director, Waycrosse), Devana Cohen (Chief Investment Officer, UJA), and Keith Stone (Managing Director, Brown Advisory) offered a candid look at how institutions approach venture today.

They outlined how venture fits into different portfolios: as a way to capture innovation and growth, as a diversifier within a broader allocation to private markets, and as a potential source of excess return over public markets.

They also spoke candidly about how they pick managers. What stands out, they emphasized, are managers with a clearly articulated thesis, a right-sized fund, and a track record of rolling up their sleeves during difficult moments. In other words, LPs are not just underwriting performance; they are underwriting GP behavior over market cycles.

Closing Thoughts

After an open Q&A, the day wrapped up with a happy hour that reminded us that while strategy and execution are vital, this business is ultimately built on relationships.

As Dan mentioned in his opening remarks, "We move fast when we have conviction, and stay steady when we don't." As we look toward 2026, we remain committed to that balance – being adaptable without losing focus, and supporting the founders who are shaping the future.

The Deciens team alongside founders and operators from our portfolio.